Taming the challenges of explosive sales spikes driven by influencer marketing: Working with Quiet, JVN has reduced its cost per order and guaranteed faster delivery, helping to keep the business price competitive and profitable.

In the cutthroat world of beauty and wellness, where influencer marketing reigns supreme, JVN Hair has emerged as a shining star. But behind the brand’s meteoric rise lies a secret weapon: a strategic partnership with Quiet that has revolutionized its order fulfillment process, enabling the brand to handle even the most explosive demand spikes with grace and efficiency.

Part of Amyris, a family of clean consumer beauty brands, JVN Hair exploded onto the scene in August 2021, offering products created by celebrity Jonathan Van Ness—an Emmy-nominated television personality, New York Times best-selling author and podcaster with a powerful presence on social media. With more than 6 million followers on Instagram and 12 million likes on TikTok, whenever he uses the power of his personal brand to showcase one of his products, demand for that product can surge dramatically. This frequent bullwhip effect creates formidable fulfillment and delivery challenges that demand skillful management of inventory placement,customer delivery times and costs so sales remain profitable.

Overall network improvements March 2022 - September 2023

19.7%

Reduced network-wide average shipping zone (Zone 5 → 4)

33.4%

Reduced average package miles traveled (1,029 → 685 miles)

Decreased

Reduced average package miles traveled (1,029 → 685 miles)

Predicting the Unpredictable

Kristanne Thompson, Project Manager in Amyris’s Consumer Brands division says that forecasting and planning are a thing of the past, and fulfillment and delivery a whole new playing field where flexibility and real-time responsiveness are key. But how can smaller, growing brands like JVN build these capabilities while keeping a lid on costs and not letting customers down?

Initially, JVN managed its supply chain out of a single warehouse based in Ohio, but this was not best suited to supporting its ambitious scaling plans. The team realized they needed a 3PL partner who could elevate them to the next level – one that would inject next-level intelligence into their growth strategy, propelling them ahead in a competitive marketplace.

“We wanted a B2C partner with a ready-made scalable platform that would allow us to grow at speed. We were impressed by Quiet’s multi-node model and inventory intelligence strengths as well as its capabilities in areas where our in-house B2C expertise was limited,” says Heath Tilley, Senior Vice President Global Operations, Consumer Division

at Amyris.

“In the fast- moving influencer era we have to be agile and adaptable without knowing how or when.”

Changing the game

It was clear to both partners that inventory was a key optimization opportunity for JVN. Among other challenges, out-of-control costs were squeezing JVN’s profit margins.

As Tilley explains, they realized that the traditional transaction-and-activity model, even if it met performance requirements, did not necessarily mean better costs nor the best customer outcome. They wanted to pay for outcomes,

not activity.

Quiet, a company founded on innovative principles, was quick to respond to this challenge with their innovative Click-to-Door (C2D) solution.

C2D draws on Quiet’s inventory intelligence to transform the traditional supply chain model, transferring accountability for storage, inventory, packing, shipping, and delivery to Quiet. Uniquely, C2D is an end-to-end promise, with Quiet accountable for the entire order process, from receipt to delivery, while JVN retains control over the customer experience. This industry-leading approach has helped JVN achieve predictable costs and delivery times without increasing risk while ensuring a reliable and quality customer experience.

According to Roberto Croce, Chief Commercial Officer at Quiet, “the C2D model helps give the team at Amyris greater confidence that the three core areas of cost, inventory and service are more predictable, freeing them up to focus on giving their customers the best possible brand experience while they scale the business.”

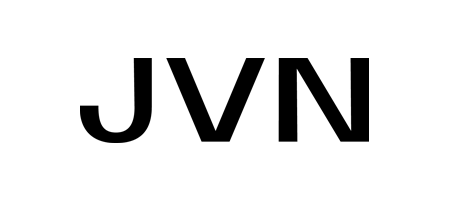

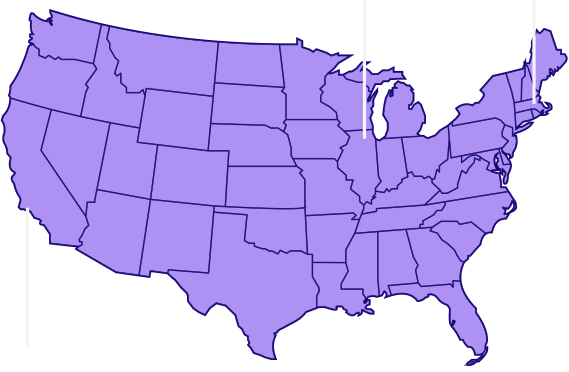

Phase 1

Shipment splits: 46% Midwest / 54% Coasts

Average distance to West Coast: 1846 miles

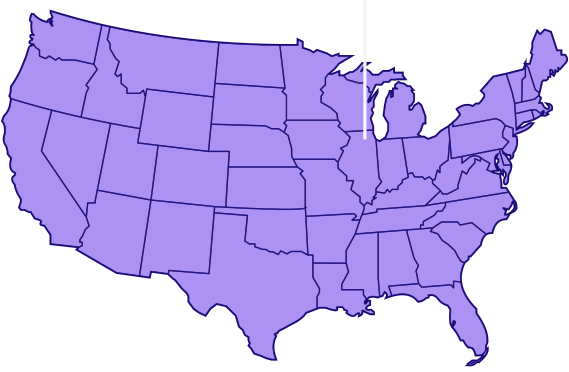

Phase 2

Average shipping zones decreased by 42.5%

Average distance to West Coast: 627 miles

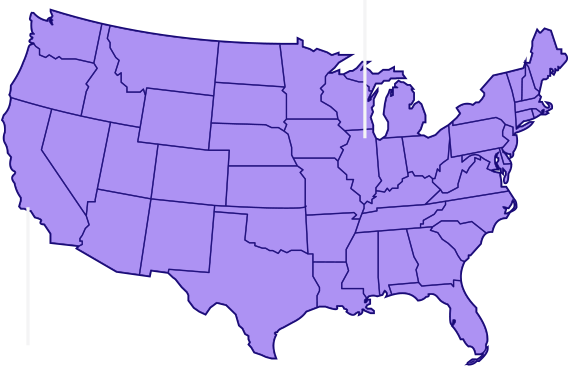

Phase 3

Average shipping zones decreased by 19.7%

Average distance all shipments:

From 1,029 to 685 miles

The Power of Partnership and Agile Operations

Perhaps the best thing about C2D is that it is a journey of continuous optimization not a destination. It’s a solution that combines smart people with smart technology to enable real-time adaptability.

“Receiving actionable data on the three value levers of cost, inventory, and service allows us to continue to adapt, innovate and drive value,” Tilley notes.

C2D’s tech-driven insight and well-established operations helped Amyris when it was time to expand facilities almost instantly. “It’s often thought that to expand into additional facilities, you need more inventory. However, with C2D’s inventory intelligence working behind the scenes, JVN was ultimately able to reduce its final-mile zones and miles traveled per package, improve time in transit, and decrease split shipments—all while its inventory footprint decreased,” explains Croce.

Amyris emphasizes that this is a shared success story rooted in the timeless principles that have always defined productive business relationships: communication and trust. As Thompson points out, neither partner has ever tried to sugar-coat the tough realities of today’s Health & Beauty sector. By making reality their friend, Quiet and JVN have created something extraordinary: an honest, dynamic, and forward-looking alliance based on a shared commitment to being the best in a relentlessly demanding and volatile business.

“I know that the Quiet team will always be there for us as true partners,” says Thompson. “If there’s a problem, the problem never gets to us because Quiet makes the required adjustments before we even see it. This allows us to refocus 100% on the things we need to focus on. Like continuing to grow our brand.”

Reach out to us to learn more.

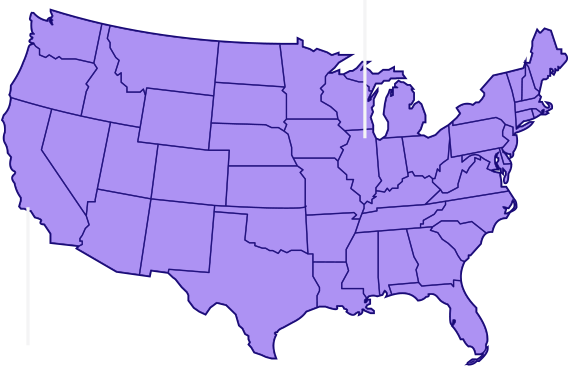

Phase 1

Shipment splits: 46% Midwest / 54% Coasts

Average distance to West Coast: 1846 miles

Phase 2

Average shipping zones decreased by 42.5%

Average distance to West Coast: 627 miles

Phase 3

Average shipping zones decreased by 19.7%

Average distance all shipments:

From 1,029 to 685 miles