As we begin the peak season of 2024, retailers and their logistics partners face a rapidly evolving landscape shaped by various key trends. Understanding the market trends is crucial for optimizing operations and meeting consumer expectations. This blog post delves into the key trends we see shaping retail logistics this year, offering insights and actionable recommendations to help your business thrive this year and in the future.

Consumer Buying Patterns

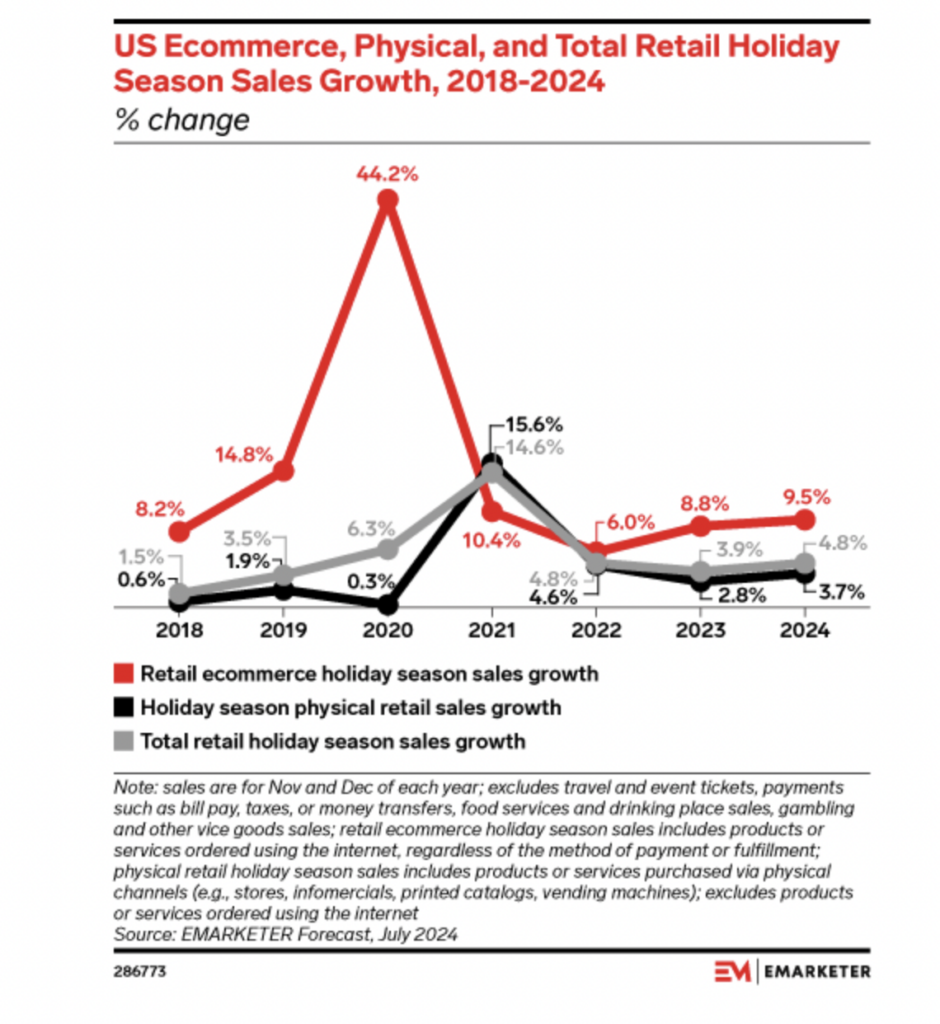

Consumer spending for the 2024 peak holiday season is expected to be modest, falling 1% off of 2023’s performance to rise just over 2%. The expectation of slow economic growth necessitates that retailers innovate their logistics and transportation strategies to maintain profit margins.

However, there is a glimmer of hope these projections are conservative: projected declines in interest rates could lead to increased disposable income for consumers. This potential increase in spending power may stimulate retail activity, particularly as inflation concerns ease.

Despite projected modest growth in consumer spending, the retail landscape is dynamic. E-commerce continues its dominance, with over 2.6 billion global online buyers. However, economic uncertainties have led to some noteworthy trends:

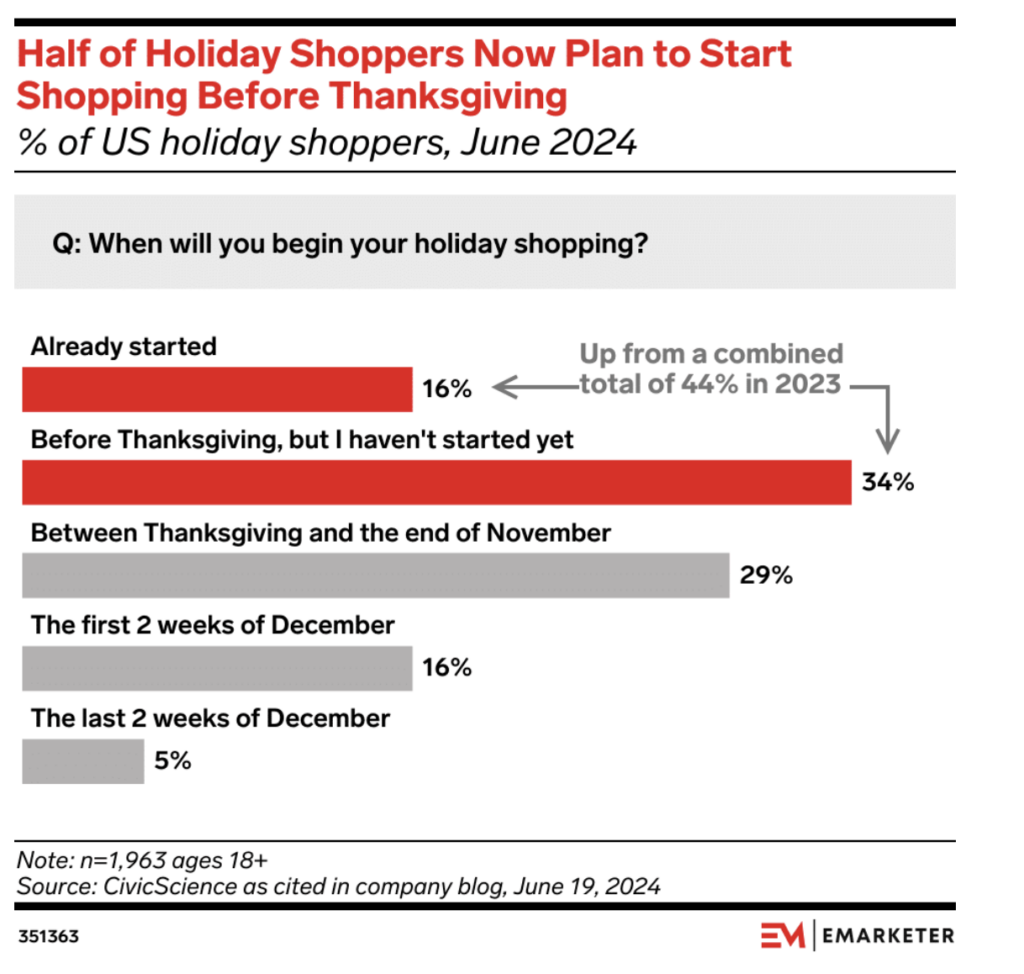

- Last-minute purchasing with an early bird exception: While many consumers are delaying purchases until the absolute last minute, this trend doesn’t extend to holiday shopping. Early October holiday sales remain a fixture, with around 50% of consumers starting their holiday shopping in October or earlier. This suggests a strategic approach to holiday spending, balancing last-minute deals with early bird promotions.

- In-season buying:Consumers are favoring in-season purchases over stocking up in advance. This trend is particularly noticeable in weather-dependent categories like apparel, where sales of sweaters spike when temperatures drop and shorts continue to sell well in warmer regions. Retailers need to align inventory and promotions with real-time conditions and consumer needs.

- Self-gifting on the rise: The trend of self-gifting is gaining traction, with 61% of shoppers, particularly millennials (73%) and Gen Z (68%), likely to purchase items for themselves while shopping for gifts. This presents an opportunity for retailers to promote self-care and indulgence during the gifting season.

- Millennials and Gen Z drive social media sales: Social commerce is booming, fueled by younger generations. Retailers must prioritize social media marketing and sales strategies. Gen Z and Millennials are making purchases on these platforms at a rate four times higher than older demographics. In fact, over a third of them reported buying something on social media within the past three months. This trend underscores the critical importance of social media marketing and sales strategies for retailers. To capture the attention and wallets of these influential consumers, brands must create engaging content, foster community, and provide seamless shopping experiences directly within social platforms.

Value Redefined: Prioritizing Quality, Sustainability, and Experience

The trend toward lower average order values, coupled with an increase in items per order, suggests that shoppers are actively seeking out deals and discounts. Loyalty programs and other value-added offerings are becoming increasingly important tools for retailers to attract and retain budget-conscious consumers.

While consumers are spending cautiously, there is overwhelming evidence that they are still willing to pay a premium for several key factors:

- Quality: A commanding 70% of consumers are ready to switch brands for better product quality.

- Sustainability: Consumers are increasingly factoring in the environmental and social impact of their purchases.

- Exceptional Experiences: This includes elements like premium packaging, fast and free shipping, and outstanding customer service. Our recent survey revealed that 52% of consumers are ready to pay more for great customer service, with one in four willing to pay up to a 10% premium.

- The Rise of AI in Retail: Consumers are embracing AI in various aspects of their shopping journey. 86% approve of its use in areas like product descriptions, marketing content, and chatbots. However, there’s still hesitation when it comes to AI’s role in strategic functions like upselling and marketing strategy development.

Key Services Shaping the 2024 Shopping Experience

As consumers increasingly prioritize quality and experience over price, the services that companies offer become a crucial differentiator in the competitive retail landscape. Here, we underscore the top services that consumers demand in 2024, reflecting their evolving expectations for convenience, flexibility, and a seamless shopping journey.

- Shipping Tracking: Real-time updates and proactive notifications on order whereabouts are now a baseline expectation for online shoppers.

- Shopping via Social Media: The integration of social media browsing and seamless purchasing is gaining traction, blurring the lines between entertainment and commerce.

- Contactless Payments: The preference for efficient, touch-free transactions at the point of sale is driving the adoption of tap-to-pay and mobile payment solutions.

- Buy Now, Pay Later Options: Offering flexible payment plans and budgeting tools at checkout caters to consumers’ desire for financial control and empowers them to make purchases with confidence.

- Curbside Pickup : This convenient, contactless fulfillment option remains popular, particularly for busy individuals seeking a streamlined shopping experience.

These services represent the evolving expectations of today’s consumers. By investing in these areas and prioritizing convenience, flexibility, and a seamless shopping experience, retailers can differentiate themselves in a competitive market and foster long-term customer loyalty.

Economic Factors

Rising Shipping Costs

- USPS: A substantial increase of 7.8% in shipping costs, effective July 14, 2024. This adjustment is part of USPS’s broader strategy to stabilize its finances amid declining on-time performance and network realignment. The changes include higher rates for various services, such as First-Class Mail and domestic postcards.

- FedEx: An average increase of 5.9% across its shipping services. This increase, while lower than previous years, reflects ongoing adjustments to maintain service quality amid a slowdown in demand.

- UPS: Similar to FedEx, UPS is also implementing a 5.9% increase in shipping rates. These adjustments are expected to impact the overall shipping costs for retailers significantly.

Shorter Holiday Season

The upcoming holiday season is 5 days shorter than in previous years, with only 27 days between Thanksgiving and Christmas this year. This means retailers will have one less weekend to entice shoppers. With consumers shopping earlier to avoid potential supply chain disruptions, retailers must ensure that their inventory management and fulfillment processes are agile and responsive. This shift necessitates a focus on efficient last-mile delivery solutions and enhanced visibility throughout the supply chain to meet consumer expectations for timely deliveries.

AI as a Retail Powerhouse

Artificial intelligence is not just reshaping industries; it’s revolutionizing the way consumers shop, and they are welcoming the change. With 92% of U.S. retailers planning to increase AI investment in the coming year, and 86% of consumers viewing this as positive, it’s clear that AI’s impact on retail is here to stay.

This isn’t just about technology for technology’s sake. Bain & Company’s research indicates that AI-powered conversational shopping assistants can boost revenue by 5% to 10%, while productivity enhancements and cost savings can significantly improve retailers’ margins. Consumers themselves are on board, with Bain’s research showing they trust AI most for personalized shopping recommendations. It’s a win-win: AI helps retailers optimize operations and deliver the tailored experiences that customers crave.

Let’s delve into the specific ways AI is transforming retail:

- Personalized Shopping: AI analyzes customer data to provide hyper-personalized recommendations, offers, and content, fostering deeper engagement and loyalty.

- Inventory Optimization: AI algorithms predict demand and seasonal trends, ensuring optimal stock levels and minimizing costly overstocks or frustrating stockouts.

- Enhanced Customer Service: AI-powered chatbots and virtual assistants handle routine inquiries, freeing human agents to address complex issues, thus improving efficiency and customer satisfaction.

- Dynamic Pricing: AI enables real-time price adjustments based on market factors, helping retailers maximize revenue and stay competitive.

- Targeted Marketing: AI-driven analysis of customer data allows for the creation of highly targeted marketing campaigns, improving conversion rates and ROI.

- Fraud Prevention: AI algorithms detect unusual transaction patterns, protecting both retailers and customers from fraudulent activity.

- Data-Driven Product Development: AI empowers retailers to understand customer preferences and market trends, guiding product development towards offerings that truly resonate.

AI is no longer a futuristic concept in retail—it’s a present-day reality that’s enhancing both the customer experience and the bottom line. Retailers who embrace AI’s transformative power are poised to thrive in the ever-evolving landscape of 2024 and beyond.

Actionable Recommendations for Retailers

Based on the evolving market landscape and shifting consumer behavior, retailers can strategically navigate the 2024 peak season and beyond by implementing the following key recommendations:

- Embrace agility and adaptability: Prepare for last-minute demand, align with in-season buying, and capitalize on early bird shoppers.

- Prioritize customer experience and value: Invest in quality, sustainability, and exceptional customer service.

- Harness the power of technology and social commerce: Leverage AI and develop a robust social media strategy.

- Navigate economic challenges: Strategically manage shipping costs and optimize inventory management.

Looking Forward to 2025

Amidst the complexity of Peak Season lies opportunity. By understanding the forces at play and embracing proactive strategies, retailers can not only navigate this peak season but also lay the groundwork for continued success in 2025 and beyond.

While it may be too late to revamp your logistics strategy for this holiday season, now is the perfect time to start planning for the next. At Quiet, we’re not just a 3PL—we’re a strategic partner with deep roots in retail. As part of the American Eagle Outfitters family, we have firsthand experience navigating the complexities of the retail landscape and a proven track record of success.

We’re passionate about sharing our expertise and insights to empower our clients. If you’re looking to gain a competitive edge and access the kind of market intelligence that most small businesses only dream of, we’re here to help.

Contact us today and let’s start building a winning strategy for 2025.