The tariff landscape is changing rapidly, and staying informed is crucial for retailers. This is where Quiet will keep you updated on the latest developments and what they mean for your business. Bookmark this page and check back often as we untangle the complexities of these shifting policies and provide you with the information you need to navigate this dynamic environment.

April 9, 2025

90-Day Pause for Most Countries, Increased Pressure on China

In yet-another surprising turn of events today, President Trump announced a 90-day pause on reciprocal tariffs for most countries that have not retaliated against U.S. trade policies. However, tariffs on Chinese imports have been dramatically increased to 125%, creating a stark divide in trade policy and significant implications for apparel brands.

What This Means for Apparel Supply Chains

- Temporary Relief for Non-Chinese Imports

The 90-day tariff pause for countries like Cambodia, Thaliand, Vietname and Sri Lanka offers temporary cost relief for apparel brands sourcing from these regions. For companies already diversifying their supply chains away from China, this is an opportunity to accelerate those efforts and stabilize costs. - Heightened Costs for Chinese Imports

The 125% tariff on Chinese goods is unprecedented and will have immediate financial implications for apparel brands reliant on Chinese manufacturing. This increase forces companies to reevaluate their sourcing strategies and logistics operations to mitigate the impact of rising costs. - Port Activity and Shipping Dynamics

With the tariff pause easing pressure on imports from non-retaliatory countries, U.S. ports may see temporary relief from congestion. However, brands sourcing from China should prepare for potential delays and increased freight costs due to heightened scrutiny and demand shifts.

Strategic Considerations Moving Forward

- Diversify Sourcing Regions

Brands should continue exploring alternative manufacturing hubs in Southeast Asia or nearshoring options closer to home. Vietnam, Cambodia, and other regional players remain key alternatives to China. - Evaluate Pricing Strategies

The sharp increase in tariffs on Chinese goods will likely affect margins and pricing models. Apparel companies must assess how these changes will impact their bottom line and consumer pricing. - Monitor Trade Policy Developments

With a 90-day window in place, it’s crucial to stay informed about potential policy changes that could further alter the global trade landscape.

This latest tariff update underscores the volatility of international trade policies and their impact on apparel logistics. While the temporary pause provides some breathing room for non-Chinese imports, the steep increase in tariffs on Chinese goods demands immediate action from brands to adapt their supply chains and operational strategies.

Quiet will continue to monitor these developments closely and provide updates as new information emerges.

April 2, 2025

Reciprocal Tariffs Commence, Canada/Mexico Pause Expires

Today marks another significant development in the rapidly evolving U.S. trade policy landscape that directly impacts retailers. As anticipated following previous announcements and the temporary measures outlined in early March, new tariff actions are taking effect.

Key Developments Today:

- Reciprocal Tariffs Implemented: The U.S. government is moving forward with its previously announced “reciprocal tariffs” strategy today. While the exact scope and specific product lines impacted across all sectors are still unfolding, this represents a notable escalation in trade measures.

- Canada & Mexico Tariff Pause Ends: The temporary pause on the 25% tariffs for USMCA-compliant goods imported from Canada and Mexico, which began on March 6th and was scheduled to last until April 2nd, has now expired. Barring any last-minute directives or specific exemptions, retailers importing qualifying goods from Canada and Mexico should anticipate the reimposition of these 25% tariffs effective today. Goods not meeting USMCA rules were potentially already subject to tariffs.

- Existing Tariffs Remain: These changes add to the existing tariff structure, which includes the 20% tariff on many Chinese goods and the general framework of 25% tariffs on most Canadian and Mexican imports. The suspension of the Section 321 de minimis entry process for certain shipments also remains a factor.

Immediate Impacts & Considerations for Retailers:

Retailers face immediate pressures from rising import and shipping costs driven by these tariffs. Ongoing port congestion continues to challenge logistics, intensifying the need for vigilant inventory management and adaptable routing. This environment underscores the critical importance of reviewing sourcing strategies, potentially exploring diversification or nearshoring to mitigate exposure.

Navigating the Changes:

The trade situation is exceptionally fluid, and further details may emerge in the coming days. Retailers must maintain flexible strategies and stay closely informed. Quiet is committed to monitoring these developments and their implications for logistics and fulfillment. For retailers finding themselves needing to adapt quickly to manage these new complexities, our rapid response team is available to help onboard new partners swiftly.

Bookmark this page and check back often as we continue to untangle these complex trade dynamics.

March 6, 2025

Canada Tariffs Rescinded Until April 2

The U.S. government has now rolled back this week’s new 25% tariffs on both Canada and Mexico. Specifically, the tariffs are currently paused for goods from Canada and Mexico that comply with the USMCA, until April 2, 2025. However, this pause is temporary, and tariffs could be reimposed after this date. Also, apparel that does not meet USMCA rules of origin may still be subject to tariffs even during this pause.

March 6, 2025

Mexico Tariffs Rescinded Until April 2

In a significant development today, the U.S. government has rescinded the recently imposed 25% tariffs on most imports from Mexico until April 2. This decision marks a crucial shift in the ongoing trade negotiations and will have immediate implications for retailers and consumers alike.

Key Points:

- Tariff Rollback: The 25% tariffs on Mexican imports, which were implemented just days ago, have been rescinded with immediate effect.

- Remaining Tariffs: The additional 10% tariff on Chinese imports (bringing the total to 20%) and the 25% tariff on most Canadian imports, along with the 10% tariff on Canadian energy products, remain in place.

- Impact on Retailers: This rollback provides immediate relief for retailers sourcing products from Mexico. It eliminates the need for price adjustments and supply chain restructuring that would have been necessary had the tariffs remained in effect.

- Consumer Benefits: U.S. consumers can expect prices on Mexican imports to stabilize, avoiding the anticipated increases that would have resulted from the tariffs.

- Ongoing Negotiations: The swift reversal of the Mexican tariffs suggests that high-stakes negotiations are actively ongoing. This development may signal a potential for similar resolutions with other trading partners in the near future.

While this development brings relief to those dealing with Mexican imports, retailers should remain vigilant. The trade situation with China and Canada continues to be fluid, and further changes may occur as negotiations progress. It’s advisable to maintain flexible strategies and stay informed about ongoing trade discussions.

Retailers using the Section 321 program should note that the suspension of this customs de minimis entry process remains in effect for now.

We will continue to update this blog as new information becomes available, providing you with the latest insights to navigate these complex trade dynamics.

March 4, 2025

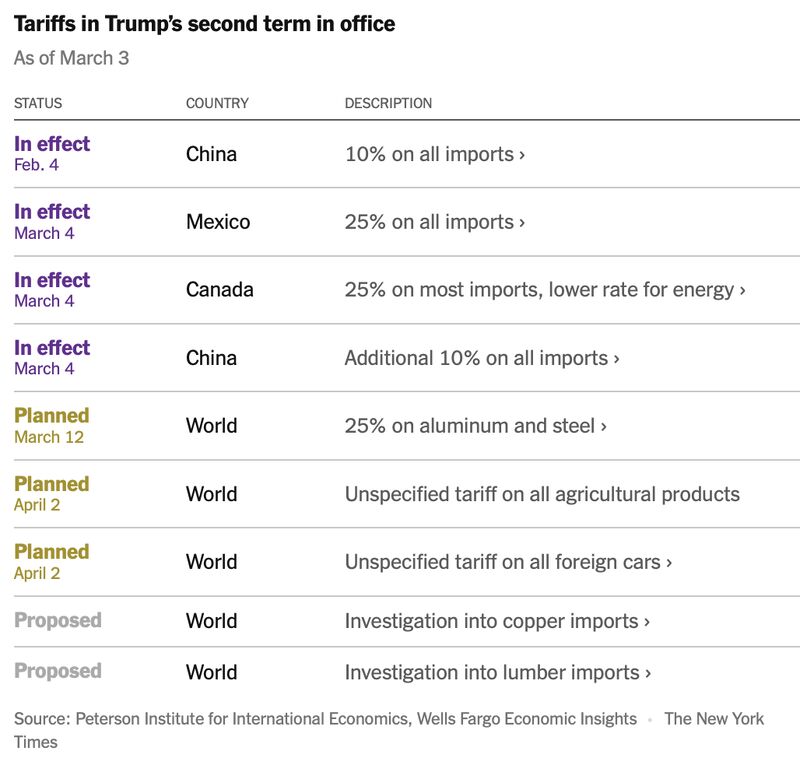

New US Tariffs Spark Trade War with China, Canada and Mexico

The United States has implemented new tariffs on imports from China, Canada, and Mexico, sparking retaliatory measures from these key trading partners.

United States Tariffs

- China: Additional 10% tariff, bringing the total to 20% on Chinese imports.

- Canada: 25% tariff on most imports, with a 10% tariff on Canadian energy products.

- Mexico: 25% tariff on most imports.

Retaliatory Tariffs

- Canada: Announced 25% tariffs on $30 billion worth of U.S. goods, with a potential expansion to $125 billion of American goods if U.S. tariffs remain in place after 21 days. Specific products affected have not been announced, but previous statements suggest targeting items such as beer, wine, bourbon, household appliances, and Florida orange juice.

- Mexico: President Claudia Sheinbaum is expected to address the tariffs at a news conference.

- China: Announced tariffs of up to 15% on a wide array of U.S. farm exports. These new tariffs will take effect on March 10, 2025.

Global markets anticipated some form of tariffs during Trump’s second term, but the duration and negotiation timelines remain uncertain. Economists warn that prolonged 25% tariffs on Mexico/Canada imports and 20% tariffs on Chinese goods could significantly impact U.S. consumers and the economy.

However, based on experiences from Trump’s first term, these tariffs may be a negotiation tactic aimed at bringing other countries to the table. It is likely that they will not remain in place for an extended period.

At Quiet, we are closely monitoring the evolving situation and have a rapid response team in place to quickly onboard new brands. We remain committed to helping our partners navigate these changes and will provide timely updates as the situation develops.

February 7, 2025

Temporary Reinstatement of Duty-Free De Minimis

The president amended the recent update to U.S. trade policy to temporarily reinstate duty-free de minimis treatment for certain goods. This means that goods that were once eligible for de minimis treatment can be imported temporarily without paying duties—until the U.S. government has systems in place to process and collect tariffs effectively.

February 7, 2025

China Announces New Tax Refund Policy for Cross-Border E-Commerce Exports

China’s State Taxation Administration (STA) has recently introduced a new tax refund policy aimed at stimulating the country’s cross-border e-commerce sector. This policy, effective immediately, focuses on goods exported through overseas warehouses and introduces a “tax refund upon departure” mechanism for goods falling under customs supervision code “9810”.

Key Provisions of the New Policy:

- Immediate Tax Refund Upon Departure: Goods exported through overseas warehouses and falling under customs supervision code “9810” can now apply for tax refunds immediately after clearing customs. This applies to both sold and unsold goods.

- Pre-Refund Application: Businesses must submit export declarations and relevant materials to their tax authorities to apply for a pre-refund.

- Reconciliation: Businesses that have applied for pre-refunds must complete a reconciliation process to adjust the refund amount based on actual sales.

- Changes and Withdrawals: Businesses must complete the pre-refund reconciliation before making changes to their refund method or withdrawing their tax refund registration.

- Documentation Requirements: Businesses must comply with supplementary documentation requirements, including using overseas warehouse-related materials and retaining sales evidence.

This new policy is expected to streamline the tax refund process, expedite refunds, and reduce costs for businesses engaged in cross-border e-commerce, ultimately enhancing their competitiveness in the global market.

February 5, 2025

USPS Ends Suspension of Shipments to China and Hong Kong as Shippers Work To Reduce Disruption

The U.S. Postal Service (USPS) has resumed accepting parcels from China and Hong Kong after a temporary suspension caused by recent trade policy changes.

USPS stated that it is working closely with Customs and Border Protection to implement a new tariff collection process while minimizing disruptions to package deliveries.

Meanwhile, major international couriers have responded differently to the changes:

- FedEx continues U.S.-bound shipments but has suspended its money-back guarantee for these deliveries.

- SF Express, China’s largest express courier, is still shipping to the U.S.

- DHL is working to limit supply chain disruptions and reduce the impact on customers.

As global shipping adapts to these new regulations, businesses and consumers may experience delays or additional costs on packages from China. Stay tuned for further updates.

February 4, 2025

10% Tariff on All Chinese Goods is in Effect

A new 10% tariff on Chinese imports went into effect today, February 4, 2025.

February 4, 2025

De Minimus No Longer Applies to Chinese Made Goods

Starting February 4th, the De Minimis rule, which previously allowed for duty-free entry of low-value goods, will no longer apply to shipments containing any China-made goods. This means that even small orders from platforms like Shein and TEMU will now be subject to customs clearance, potentially leading to increased costs and delays.

This means transitioning to formal custom entries and working with providers to decrease delays and reduce impact.

Additional points:

- The tariffs apply to goods entered for consumption or withdrawn from warehouses for consumption after 12:01 a.m. EST on February 4, 2025.

- Goods already in transit before 12:01 a.m. on February 1, 2025, are exempt from these tariffs.

- The tariffs are in addition to any existing duties, fees, or charges applicable to the covered imports.

- Duty drawback will not be allowed on affected imports.

The tariffs will remain in effect indefinitely until the president decides to remove them.

February 3, 2025

Mexico and Canada Tariffs Postponed for 30 Days

President Trump has agreed to suspend the proposed 25% tariffs on Canada and Mexico for 30 days after last-minute negotiations. Both countries committed to enhanced border security measures to address U.S. concerns about illegal immigration and fentanyl trafficking.

December 26, 2024

Mexico’s New 35% Tariff

On December 19, 2024, Mexico raised tariffs on textile and apparel imports to 35% for finished goods and 15% for unfinished products.

Effective from December 20, 2024, through April 22, 2026, this move is designed to shield local industries from low-priced imports, particularly from non-FTA countries like China.

Read the full post here: Mexico’s New Textile Tariffs: A Wake-Up Call for Apparel Retailers